- Real CBS Makeovers: 3 Case Studies of SME Owners Who Turned Bad Credit Around

- Ask SmartLend: Why Did My SME Loan Get Rejected?

- Introducing SmartLend Concierge: A Helping Hand for SME Loans

- Legal Ways to Lighten Your Company’s Tax Burden in Singapore

- A Wake-Up Call on Director Duties: The Envy Saga and Other Cautionary Tales in Singapore

- Surviving Cash Flow Crunch: How SMEs Can Use Short-Term Financing Wisely

- Unmasking Business Loan Fraud: How Syndicates and Rogue Brokers Game Singapore’s Lending System—and How AI Can Stop Them

- From Rejection to $60K Approval in 3 Days: How a Fishing Pond Business Got Funded Despite a Flawed Credit Report

- Lender Spotlight: How Poss Capital and SmartLend Partnered For Singapore SMEs

- Which Lender is Right for Your Business in 2025? Banks, Money Lenders, or Alternative Finance

Why BNPL Is Not As Sustainable As You Think? - A Perspective On Why Pace Failed

The article was published on 09 Nov 2023 and was most recently updated on 10 Nov 2023

Disclaimer: Please note that the opinions expressed in this article are those of the writer and do not necessarily reflect the views of our website.

Introduction

Buy Now, Pay Later (BNPL) has gained significant popularity in recent years, offering consumers the option to make purchases and pay for them in installments. While the concept of BNPL may seem appealing and convenient, there are concerns that this business model may not be sustainable in the long run.

In this article, we will delve into the reasons why BNPL may face challenges as a sustainable business, including issues with credit checks, transaction volume, spending limits, and its impact on consumer debt levels.

How Popular is BNPL in Singapore?

BNPL (Buy Now, Pay Later) in Singapore lately has seen a rapid growth rate and a projected increase in market share. According to recent reports, the BNPL sector in Singapore has experienced a remarkable growth rate, indicating its rising popularity among consumers. It is algorithmically projected to continue its upward trajectory in the coming years, making it a major contender in the retail and e-commerce industries. The recent liquidation of Pace seems to indicate otherwise...

Main BNPL players in Singapore

Among the various BNPL options available in the Singaporean market, Atome stands out as the most popular choice.

Atome's success can be attributed to its user-friendly interface, flexible payment plans, and wide acceptance among merchants.

In Singapore, there are several main BNPL players that have established themselves in the market. Another key player in the BNPL sector is Klarna, a global phenomenon that has expanded its services to Singapore.

Known for its partnership with retailers, Klarna offers flexible payment plans and a smooth user experience. By allowing customers to split their payments into manageable installments, Klarna has become a popular choice among consumers for making big-ticket purchases.

Apart from these specialized BNPL platforms, Singapore-based payment processing platforms like Stripe and PayPal have also ventured into the BNPL space. By leveraging their existing infrastructure, these platforms offer BNPL services as an additional option for customers. With their widespread usage and integration with other online platforms, Stripe and PayPal provide an added layer of convenience for consumers seeking flexible payment solutions.

- Atome is the second most popular BNPL option in Asia with a 20.36% market share, behind Klarna (23.75%).

- Also, the Singapore-based payment processing platform Stripe has gained popularity as a preferred payment method worldwide. Stripe is currently ranked as the 9th most popular payment method globally, with a market share of about 3.89% according to Singapore Business Review's article.

- PayPal is the top payment option in Singapore.

Why BNPL Company "Pace" Failed and is in Liquidation Recently?

In a surprising turn of events, Singaporean Buy-Now-Pay-Later (BPNL) startup Pace recently faced failure and subsequent liquidation. Several factors contributed to their inability to continue business operations, ultimately leading to their downfall.

The company struggled to establish a significant market share within the highly competitive BNPL industry even after raising USD40 million Series A funding from Pan-Asian group of investors in 2021. With giants like Afterpay and Klarna dominating the market, Pace may have failed to attract a substantial customer base and generate sufficient transaction volume to sustain its operations.

According to a statutory declaration (August 2023), they are unable to continue business operations due to their financial liabilities.

So far, Pace has not released an official media statement regarding this matter. However, their lack of response has generated numerous comments on different platforms, including their social media channels and App Stores. Many people have expressed confusion over the absence of the redemption service in the company's mobile app. You can opt in to read more about this on The Business Times here.

Read also: All You Need To Know About Corporate Bankruptcy In Singapore

Pace's Background

In the year 2021, Pace burst onto the scene with an innovative and groundbreaking idea - an omnichannel platform that revolutionized the way consumers paid for their purchases. With just a few simple clicks, customers could split their bills into three equal, interest-free payments over a span of 60 days.

It was a game-changer, encouraging sustainable spending and empowering individuals to shop with ease and peace of mind. It was.

In its impressive expansion, Pace once boasted over 3,000 points of sale throughout Southeast Asia, even acquiring the renowned BNPL company, Rely, in March 2022.

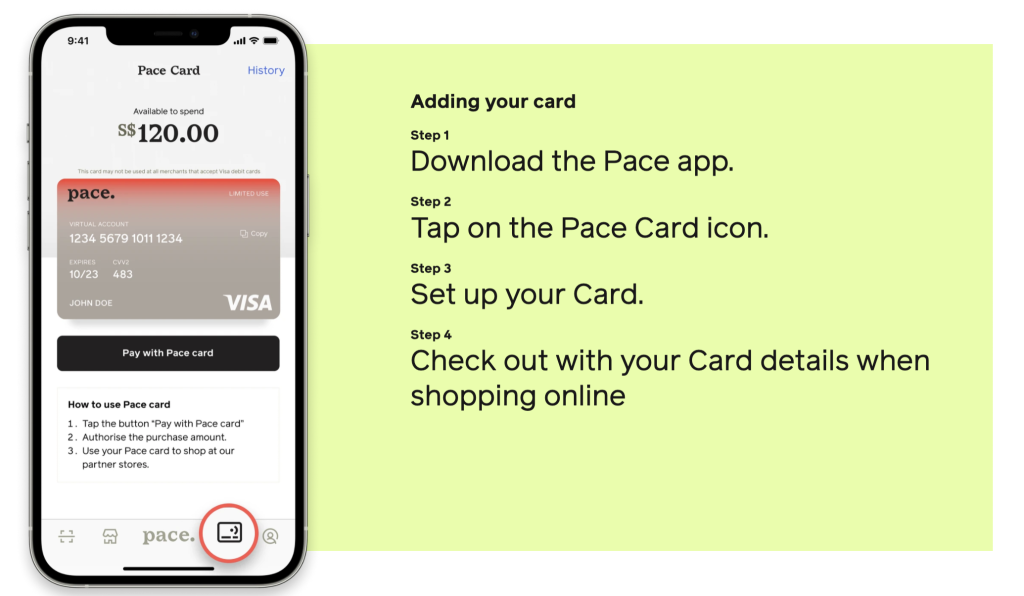

After acquiring Rely, Pace quickly launched their digital Pace Card (image below) to offer a better online payment experience.

The unexpected business insolvency of Pace has surprised customers, highlighting the uncertainty and risk that startups and the financial sector can face.

Credit Risk of BNPL - More Stress On Industry Standards

Lenders and BNPL providers are now under increased pressure to implement stricter credit assessments and affordability checks to prevent defaults and help customers make informed financial decisions.

Credit Checks and Credit History:

Traditional credit lines, such as credit cards, require individuals to undergo credit checks to assess their creditworthiness. In contrast, BNPL services often have lenient or even nonexistent credit checks, allowing consumers with poor credit history to access credit. While this may seem inclusive and appealing, it ultimately exposes BNPL providers to a higher risk of default and may contribute to an increased level of consumer debt.

Transaction Volume and Credit Limits:

BNPL services commonly allow individuals to make discretionary purchases, including big-ticket items, without upfront payment. This convenience can lead to an increase in overall purchases and transaction volume. However, without careful monitoring and evaluation of credit limits, individuals may accumulate debt beyond their capacity to repay, resulting in financial strain and potential defaults.

Impact on Credit Reports and Scores:

BNPL activity is not always reported to credit bureaus or considered in credit scoring processes. Although this may initially seem beneficial for consumers, it hinders the creation of an accurate credit picture. Without a comprehensive understanding of an individual's credit situation, lenders and credit agencies may struggle to accurately assess their creditworthiness, potentially leading to unfavorable terms for consumers and higher interest rates.

Read also: Comprehensive Guide To Understanding Moneylenders Credit Bureau Report (MLCB)

Potential for Credit Fraud and Money Laundering

Credit Fraud in BNPL:

The absence of traditional credit checks, such as credit history and credit scores, in BNPL services opens the door for individuals with a bad credit risk to exploit the system. Fraudsters can manipulate BNPL services to make big-ticket purchases or commit discretionary spending beyond their means, creating a substantial amount of consumer debt. They may also use stolen identities or falsified documents to obtain credit, further exacerbating the risk of credit fraud.

Money Laundering in BNPL:

The nature of BNPL transactions makes it attractive for money laundering activities. Fraudsters can exploit the lack of additional credit worthiness assessments and the absence of stringent checks by credit bureaus and agencies. They can split large transactions into smaller ones across multiple BNPL providers to evade detection. Additionally, the anonymity provided by BNPL services makes it easier for illicit funds to be transferred and hidden in seemingly legitimate purchases.

Read also: Anti-Money Laundering (AML) in Singapore: What are the Compliances and Regulations? [2023 Edition]

Potential Solutions for Businesses & The Government

However, due to increasing prices, some financially-strained shoppers are resorting to alternative payment methods for everyday expenses such as coffee, filling up at the gas station, or buying groceries.

Economists and consumer advocates are concerned about the surge in the use of these services in Singapore, as it lacks transparency and regulatory oversight, leaving them unsure about the amount of debt Singaporeans are accumulating.

MAS does not include Buy Now, Pay Later (BNPL) data because it is usually provided by non-bank sources and not reported comprehensively to credit bureaus. This means that there is currently no publicly accessible database containing information on BNPL-related consumer debt levels, transaction volume, delinquency rates, and fees and interest charges.

What's Next? New BNPL Code of Conduct by March 2024

In a move to enhance consumer protection and promote responsible lending practices, Singapore is set to introduce a new BNPL Code of Conduct by March 2024. This code aims to address concerns regarding the sustainability of the BNPL industry, highlighting the need for better regulation and oversight.

Provisions and Guidelines:

The code, which aims to protect consumers and ensure responsible lending practices, requires existing players to comply from Nov 1, 2023 and be accredited by Mar 31 next year. New entrants must also go through the same process before offering BNPL services.

The BNPL Code was launched by the Singapore FinTech Association and some industry players in October 2022, under the guidance of the Monetary Authority of Singapore. Six BNPL providers operating under the code are Ablr, Atome, Grab, LatitudePay, SeaMoney, and ShopBack.

Previous BNPL Code: Customers have a maximum limit of S$2,000 for outstanding payments with a "buy now, pay later" (BNPL) provider. However, if they pass an additional credit assessment considering factors like income and credit information shared across all BNPL providers, they may be able to exceed this limit.

Update on 10 Nov 2023:

In the latest developments regarding Buy Now, Pay Later (BNPL) providers in Singapore, a series of significant measures are being implemented to safeguard consumers and ensure the responsible operation of these services.Six prominent BNPL providers (Ablr, Atome, Grab, LatitudePay, SeaMoney, and ShopBack) are set to undergo a comprehensive assessment over the next few months. The successful players will be granted the prestigious accredited Trustmark, which is expected to be available from early 2024.

To protect consumers from excessive late fees and misleading advertising, additional safeguards have been put in place. A cap on late fees will provide users with a safety net, preventing them from falling into financial distress. Furthermore, providers are required to ensure their advertising and promotional materials are clear, transparent, and free from misleading or deceptive information, reinforcing the commitment to ethical business practices.

Important Note: A critical element of the new regulatory framework is the requirement for BNPL providers to seek re-accreditation every three years following the initial Trustmark award. This ongoing evaluation will ensure that providers continue to maintain the highest standards of service, transparency, and compliance.

A key component of these measures is the introduction of a credit bureau run by global information technology services company Experian. This credit bureau will consolidate and share credit information among all BNPL service providers. This information will encompass a customer's outstanding balances across various providers, helping users make informed decisions and avoid accumulating excessive debt.

Expected Benefits and Challenges:

The newer BNPL Code of Conduct is expected to bring several benefits. It will promote responsible lending, reduce the potential for consumer overindebtedness, and enhance consumer confidence in the BNPL industry. However, challenges should be anticipated, including the need for implementation and enforcement, managing compliance costs for businesses, and striking a balance between consumer protection and industry growth.

Conclusion

As Singapore prepares to implement the new BNPL Code of Conduct by March 2024, the industry can anticipate greater regulation and a shift towards responsible lending practices. While this may present challenges, it is a step in the right direction to ensure the sustainability and long-term viability of the BNPL sector, providing consumers with a safe and transparent option for managing their purchases.

To ensure the long-term viability of BNPL, it needs to balance accessibility, transparency, and responsible lending. This will make sure that the BNPL model remains a sustainable payment option in the financial landscape.

Read also: Guide to Start-Up Business Loans in Singapore 2023 Edition

Frequently Asked Questions

What is BNPL?

BNPL stands for "Buy Now, Pay Later" and is a payment option that allows consumers to make a purchase and split the cost into installments without incurring interest charges.

How does BNPL work?

When using BNPL, consumers can select this payment method at the checkout and pay for their purchases in installments over a specified period. This eliminates the need for upfront payment and provides greater flexibility in managing expenses.

Are credit history checks conducted for BNPL?

While some BNPL providers may conduct credit history checks, others do not, as the decision to approve a purchase is primarily based on factors such as affordability and transaction history.

What are the risks associated with BNPL?

One of the main concerns is credit risk, as consumers may overspend and accumulate debt without the traditional credit limits and checks. Additionally, late payments or defaulting on BNPL purchases can negatively impact credit scores.

How does BNPL affect businesses?

BNPL has gained market share in Singapore, offering businesses increased transaction volume and attracting more customers. However, businesses must weigh the potential benefits against the credit risk and the impact on their operations and cash flow.

In conclusion, BNPL is a popular payment option in Singapore that offers convenience and flexibility. However, both consumers and businesses must understand and mitigate the credit risks associated with this model.

Read also: Guide to Start-Up Business Loans in Singapore 2023 Edition

Read also: Comprehensive Guide To Understanding Moneylenders Credit Bureau Report (MLCB)

Read also: Anti-Money Laundering (AML) in Singapore: What are the Compliances and Regulations? [2023 Edition]

-------------------------------------------------------------------------------------------------------

Got a Question?

WhatsApp Us, Our Friendly Team will get back to you asap :)

Share with us your thoughts by leaving a comment below!

Stay updated with the latest business news and help one another become Smarter Towkays. Subscribe to our Newsletter now!

Related

From Values to Value: How Far East Organization Integrates Christian Principles in Business

Nov 07, 2023

.png)