This article was first published on 19 Oct 2020 and has been updated with new information

31 May 2021- IRAS withholds S$85M in wage support to 2,600 Employers. These comprise S$52M from JSS claims and S$33M in JGI claims from some 2,600 employers

Employers that had provided fabricated documents to substantiate false claims has been referred to the police for futher investigations, with 10 such cases for JSS claims so far

The Jobs Support Scheme (JSS) October payout has been announced to be disbursed from 29th October 2020 onwards, with more than 140,000 employers to receive this payout. Over S$5.5 billion will be paid out to subsidise the wages of about 1.9 million local employees for the months of June to August 2020. Together with the October payout, a total of S$21.5 billion would have been disbursed.

Jobs Support Scheme (JSS)

JSS was introduced in Budget 2020 to support businesses in Singapore to stay afloat amid the Covid-19 pandemic. It helps to relieve companies’ cash flow by supporting wage costs for local employees - Singaporeans and Permanent Residents. This will also enable employers to retain their local employees during this period of economic uncertainty and prevent unemployment rates from spiking.

JSS payout was initially announced to support employers by offsetting part of the wages of local employees from October 2019 to July 2020. It was subsequently extended to include August 2020 wages, and as of 17th August 2020, it has since been extended by up to seven months to March 2020.

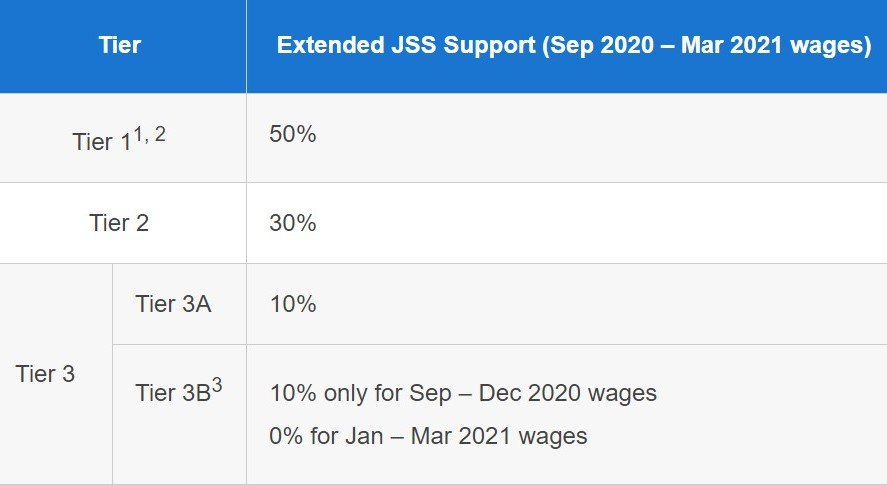

The extended JSS payouts will be in March and June 2021, with the level of wage support being varied based on the tier and sector of respective companies:

1The Built Environment sector will receive Tier 1 support for two more months, up to Oct 2020 wages, and thereafter Tier 2 support for Nov 2020 to Mar 2021 wages. This is in line with the phased resumption of construction activities.

2All sectors will receive Tier 1 support for the months of April and May 2020 (during the Circuit Breaker). Thereafter, firms that continue to not be allowed to resume operations on-site will continue to receive Tier 1 support until they are allowed to re-open, or Mar 2021, whichever is earlier.

3Tier 3 sectors will be sub-divided into Tier 3A and Tier 3B. Tier 3B comprises the following sectors: biomedical sciences, precision engineering, electronics, financial services, information and communications technology, media, postal and courier, online retail, and supermarkets and convenience stores. These sectors have been managing well, and are less affected by COVID-19 than most other sectors. As such, JSS support will be provided to cover up to Dec 2020 wages.

Source: IRAS

Read also: COVID-19 Fortitude Budget: Enhancements to Jobs Support Scheme (JSS 2020)

Abuse of JSS

Unfortunately, whenever there are benefits available, the possibility of abuse and dishonesty is bound to happen. As of 2nd October 2020, a total of 444 employees have been denied JSS payouts amounting to almost S$10 million, with 4 cases being reported to the police for investigations.

Meanwhile, another 2,200 employers are being reviewed for the previous JSS payout in July 2020. These employers under review by the Inland Revenue Authority of Singapore (IRAS) will have to submit supporting documents to show proof of the authenticity and accuracy of mandatory CPF contributions made, before they will be released of the JSS payout.

Should any discrepancies be found during the review, the JSS payouts will be adjusted or denied. In addition, any dubious cases will also be referred to the police, and employers may be charged with cheating and face imprisonment of up to 10 years on top of a fine.

As part of IRAS’ effort to ensure that JSS payouts are fairly and accurately disbursed, “employers are encouraged to review the mandatory CPF contributions for employees to ensure that they have contributed the appropriate amount ahead of the October JSS payouts.”

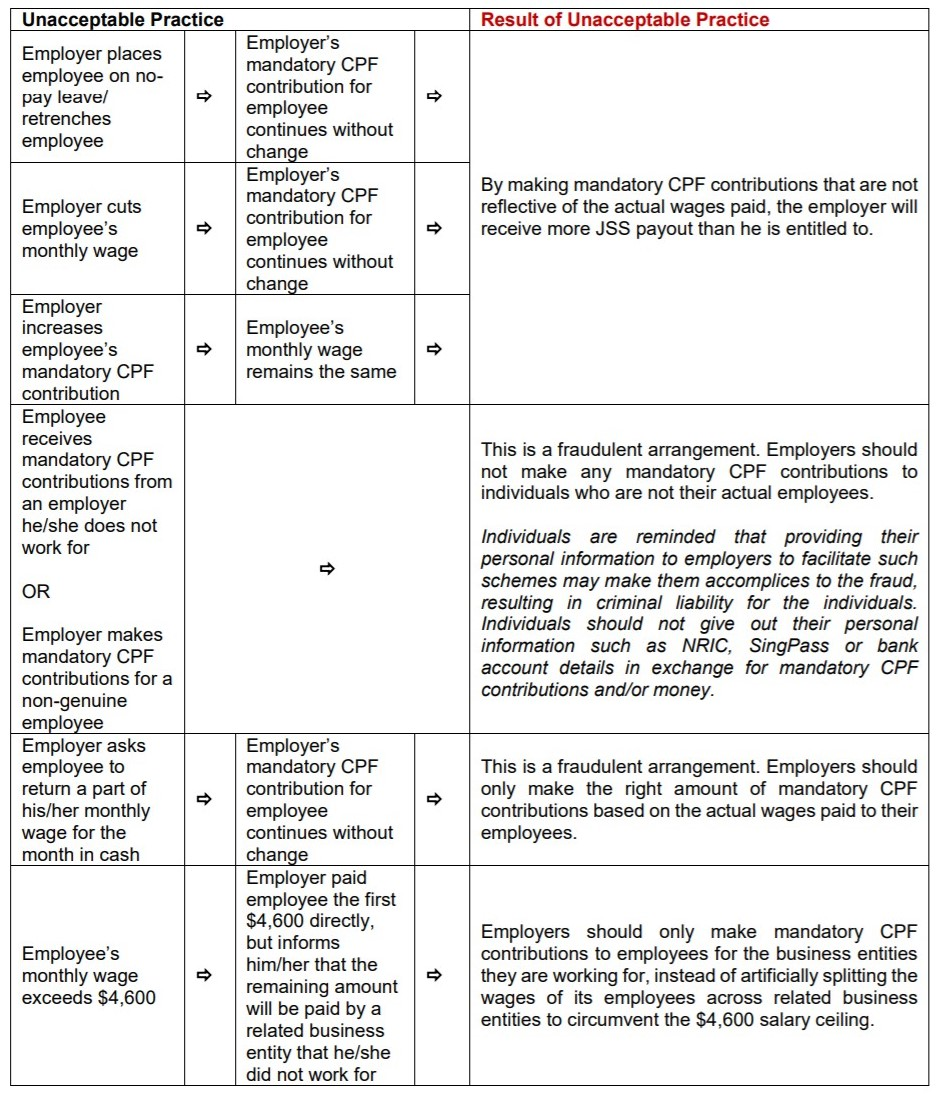

Examples of JSS abuse include making purported mandatory CPF contributions for non-genuine employees, continuing purported mandatory CPF contributions who have been retrenched or put on no-pay leave, and artificially splitting the wages of employees across multiple related business entities.

The list of common examples of unacceptable practices and consequences can also be found below:

List of common unacceptable practices

Source: IRAS

Position of Google AdSense code here, The Ad will appear after you have saved content.

This message show only in editor Backend, we will remove it in article.

Last but not least, if you are still confused with which tier of co-funding your company is eligible for, you can enquire via JSS Additional Tier eligibility, or call 1800-352-4728 (8am to 5pm from Monday to Friday).

Please also note that the JSS payouts are made to eligible employers, and not to employees. There is no need to apply for JSS, IRAS will notify eligible employers by post of the tier of support and the amount of JSS payout payable to them, and employers have the flexibility to allocate and use the payouts necessary for business operations.

Read also: 3 Key Things You Need To Know About Jobs Support Scheme JSS Payouts on 29th July and October 2020

Read also: COVID-19: Smart Towkay's Essential Business Survival Guide for This Pandemic

Read also: Government Support: More Grants and Loan Support for SMEs 2020

-------------------------------------------------------------------------------------------------------

Not sure whether your company can be qualified for bank loans or alternative lending? Try our A.I assisted loan, and Smart Towkay team will send you a lending report within 24 hours' time. With the lending report, we aggregate and recommend the highest chance of approval be it with BANKS / FINANCIAL INSTITUTIONS or Alternative lenders like Peer to Peer Lenders or even B2B lender!

Got a Question?

WhatsApp Us, Our Friendly Team will get back to you asap :)

Share with us your thoughts by leaving a comment below!

Stay updated with the latest business news and help one another become Smarter Towkays. Subscribe to our Newsletter now!

Real CBS Makeovers: 3 Case Studies of SME Owners Who Turned Bad Credit Around

Real CBS Makeovers: 3 Case Studies of SME Owners Who Turned Bad Credit Around Ask SmartLend: Why Did My SME Loan Get Rejected?

Ask SmartLend: Why Did My SME Loan Get Rejected? Introducing SmartLend Concierge: A Helping Hand for SME Loans

Introducing SmartLend Concierge: A Helping Hand for SME Loans Legal Ways to Lighten Your Company’s Tax Burden in Singapore

Legal Ways to Lighten Your Company’s Tax Burden in Singapore A Wake-Up Call on Director Duties: The Envy Saga and Other Cautionary Tales in Singapore

A Wake-Up Call on Director Duties: The Envy Saga and Other Cautionary Tales in Singapore

.jpeg)